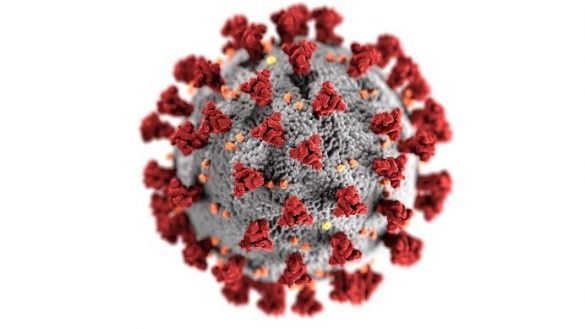

Debt affects a large proportion of UK adults each year, but the impact of the Covid-19 pandemic has exacerbated problems further, according to June 2021 data released by Step Change, the debt management charity.

Debt affects a large proportion of UK adults each year, but the impact of the Covid-19 pandemic has exacerbated problems further, according to June 2021 data released by Step Change, the debt management charity.

Covid has had a significant impact on people’s lives over the last year, but it has been a particularly hard hit for those with financial difficulties.

Many have found themselves struggling to manage their finances due to lower incomes, job losses and health difficulties.

As a result of this, issues with debt have become increasingly prevalent. According to Step Change Covid was the fifth most common reason for debt mentioned by new clients throughout 2020. In June, one in ten new clients cited the pandemic as fueling their debt problems.

Despite the impacts of the pandemic, debt affects a vast number of adults each year, with many unaware of how to control and manage this type of situation.

What The Loans Engine can do to help?

The Loans Engine is a broker that arranges a wide breadth of secured loan products for consumers, and one of the most frequent uses for the borrowing is debt consolidation.

Consolidating debts into one lower and easier to manage monthly payment can help to relieve some of the immediate pressures associated with debt. It may also give individuals the chance to get a lower interest rate.

Whilst this can mean paying back a greater amount of interest overall, because you repay over a longer period, it can help individuals to better balance monthly income and outgoings.

As a specialist in the market, The Loans Engine has access to products with flexible criteria, which means they are well equipped to handle any type of debt consolidation cases.

This includes those who may have missed payments, mortgage arrears, CCJ’s and defaults – and potentially customers that have debt management plans, IVAs, or a discharged bankruptcy on their credit file. To find out more about the options available for any specific circumstances, call The Loans Engine.

Debt Consolidation Mortgage Can Assist

A debt consolidation mortgage can be an invaluable tool to assist individuals in recovering control of their financial situations during these trying times. By consolidating multiple debts into one mortgage loan, individuals can reduce payments while reducing overall interest rates – offering advantages like easier budgeting, lower costs and potential long-term savings. Debt consolidation mortgages enable individuals to streamline finances more effectively while better-managing debt efficiently – providing the opportunity for true financial independence following COVID-19.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

To discover more about the wide range of secured products The Loans Engine offers visit: https://www.theloansengine.co.uk/secured-loans/.