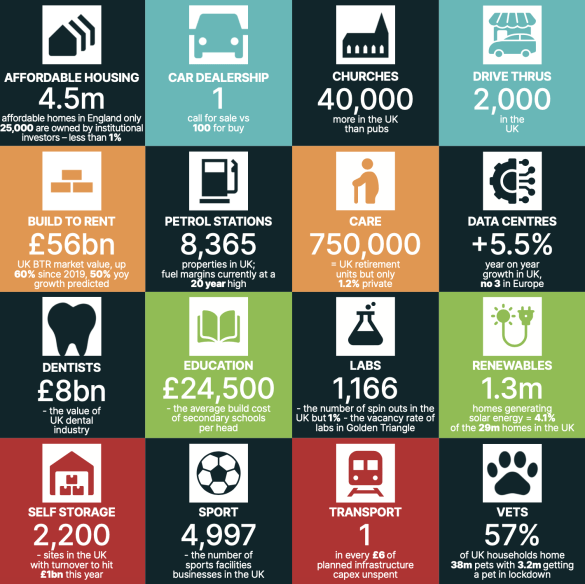

– Huge opportunities to be found in Automotive, Dentists, Renewables, Roadside and Vets.

– Sectors that are most likely to be impacted by this year’s political roundabout are Education, Foodstores, Transport & Infrastructure.

– Positive post-Covid changes have driven performance in Care Homes, Labs and Sport.

– Industries most in need of planning reform: Affordable Housing, Data Centres and Renewables.

Investors looking to diversify portfolios and seek opportunities to add income and value are increasingly turning to niche assets, leading Alternatives real estate adviser Rapleys says.

The property consultancy has launched its inaugural Alternative Assets report, An Alternatives View, which brings together its unique depth of knowledge and experience from 16 alternative industries. The report assesses performance, outlook, challenges and opportunities with themes and trends that traverse across various niche assets within the likes of Automotive, Healthcare, Infrastructure, Living, Retail & Leisure and Not-for-Profit.

Justin Tuckwell, Managing Partner of Rapleys, said: “On top of our longstanding services in the more traditional sectors, we have also emerged as the national leader in Alternatives and niche property. As such, we wanted to demonstrate how large this part of the real estate market is and highlight the opportunities and challenges in asset classes that investors may not even be aware exist, where developers can add real value and where occupiers need expert real estate advice. This is the first time such a diverse array of assets has been brought together to guide property stakeholders on these complex environments with their own bespoke macro and micro issues, pressures and policy on top of real estate requirements.”

The report highlights that several industries have outperformed all others over the last three years thanks to specialised fundamentals and increasing investor interest. These include Automotive & Roadside across all four assets covered in the report – Car Dealerships, Drive Thrus, Petrol Stations and Self-Storage seeing huge growth across both capital values and rents.

Labs have also been a success story with 2022 and 2023 seeing a wall of investors looking to enter the UK market. While this has dissipated somewhat – either money has found a home or experienced development partners are no longer available – long-term, the positives remain.

BTR has seen huge growth but with so much competing development in the market, the pace of growth will be curtailed. Care Homes & Retirement have also shown strong performance as they offer a range of schemes to cater to different needs. Following the Covid-19 pandemic, there has been a shift towards quality, attracting new entrants to the market and enhancing planning authority understanding and community acceptance.

Fewer of the assets are expected to continue to grow at this speed but some have been earmarked by Rapleys’ market specialists for ongoing success with Drive Thrus and Self-Storage at the top of the list whilst to a lesser degree, Petrol Stations, Labs, Dentists, Care Homes and Affordable Housing are expected to continue with a positive outlook for performance.

Rebecca Harper, Head of Investment at Rapleys, said: “We have seen increased interest by investors in alternative and niche assets as they seek value-add opportunities and to diversify their portfolios. By recognising challenges, working with experts, and gaining a competitive edge, there are opportunities across all 16 sectors highlighted within our report, with huge growth to be unlocked if you know where to look.”

Some challenges were common across all 16 industries, notably the rising cost of materials and labour post-Brexit which threatened the viability of development or work across the board. Planning was also notably more difficult for many of the assets, likely down to a lack of understanding and familiarity at local authority level.

An increased focus on health & safety post Covid-19, Grenfell and the death of Awaab Ishak in 2020 has also been noted across Affordable Housing in particular with increasing fines issued to Registered Providers by the Regulator. Education also found itself under the spotlight with asbestos and the RAAC crisis in particular leading to calls for urgent inspections nationwide and some school closures.

Political instability and an associated lack of confidence has led to a ‘wait and see attitude’ with many landlords choosing only to invest capital when it’s absolutely necessary and occupiers expanding or refurbishing when there’s a guaranteed payback. Foodstores are a key example of this where there are lots of ‘requirements in the market’ but little actually coming to fruition.

What has been challenging for some has boosted other sectors. A post-Covid-19 rebound has benefited the sporting world, with fans demanding a more physical and sensory experience than ever post lockdown while Care Homes, Dentists and Labs have seen uplifts thanks to the attention on the healthcare and science the pandemic brought about, and Vets saw increasing demand following the trend of lockdown dogs. While the church itself lost thousands of physical worshippers, church properties have been on the market in abundance with Rapleys transacting more than double each year since before 2020. Similarly, Drive Thrus benefited from a ‘contactless experience’ and Self-Storage from people wanting to maximise their space at home.

Some sectors have great potential to grow if the planning system can be reformed in order to support bespoke development. With huge demand pressures, data centres and affordable housing both need planning reforms to support supply delivery.

Many planning regulations were put together with housing in mind but not necessarily Affordable Housing where viability is always a challenge and greater flexibility and incentives may be needed. For Data Centres, compliance with sustainability is proving challenging to meet practically and some middle ground must be found in order to support the rise in AI, data storage and connectivity demands. Similarly for renewables there’s a focus on generating our own electricity and meeting net zero targets but the understanding and support of some initiatives is lacking at planning and community level. As a general point across the alternative sectors, the NPPF was notably light on employment content so larger scale thinking and reforms within the system, coupled with education of local authorities and communities are needed.

Robert Clarke, Senior Partner at Rapleys, adds: “Our report has highlighted numerous areas that government can actively work on to improve performance and resilience in these industries, whether it’s funding crucial repair works, planning or policy reforms, educating civil servants and communities or collaborating with private sector experts to improve understanding and commercialism. We will be bringing these ideas to their attention and shining a light on the opportunities and challenges in these markets regularly so that Alternatives get the attention they deserve going forwards. As is the fast-paced world we operate in, we are already thinking ahead to the next report and are keeping on top of the trends and changes in all of the property sectors to continually provide our clients with competitive advantage and value-led opportunities.”